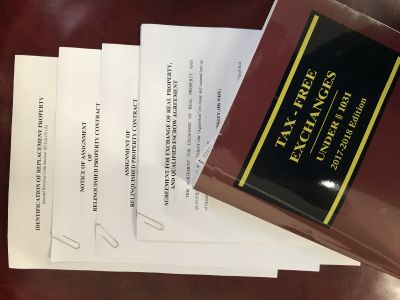

1031 Exchanges

You can elect to do a 1031 Exchange of qualified business properties in a

David Crader, Attorney at Law, LLC can help you with a 1031 Exchange and everything involved.

We have the experience to get you through the process quickly, efficiently and easily.

IRS Code: 1031 generally provides that the 1031 exchange of certain types of properties will not result in the recognition of gain or loss and will not incur

“No gain or loss shall be recognized if property held for productive use in a trade or business or for investment purposes is exchanged solely for property of a like-kind.”

By using a “qualified intermediary”, a taxpayer can convert what would otherwise be a sale and subsequent purchase into a 1031 Exchange with no recognition of capital gain.

Learn more about 1031 Exchanges of